How do you line up your money with your why?

Often as our clients trusted financial advisers we are in the privileged position to sit with them as they outline their greatest fears, their greatest aspirations and how those aspirations aren’t being met because money or life gets in the way.

Our role as independent financial advisers is to help our clients understand the role money plays in their own life. We can help people work out whether how they want to live their life is achievable by considering their current level of capital (money), their ability to generate more capital (money) through personal exertion and how all of that interacts with how much tax the government requires you to pay.

Back in 2006 a movie was released titled "The Pursuit of Happyness" - for those that haven’t seen it, Will Smith plays a semi-homeless family man with a relentless pursuit to change his family's financial position (Spoiler alert - he does). The movie speaks to the great American dream "if you work hard, you will be a success and have enough money to make you happy".

The view we often take which is supported by research is that there is a level of happiness that you achieve by having all your Fixed costs covered. Think things like rent, mortgage, utility bills, kids clothing etc. check out the link to this study for more information -

https://www.nature.com/articles/s41562-017-0277-0.

Beyond this, your level of happiness doesn’t increase as exponentially as populist culture would have us believe.

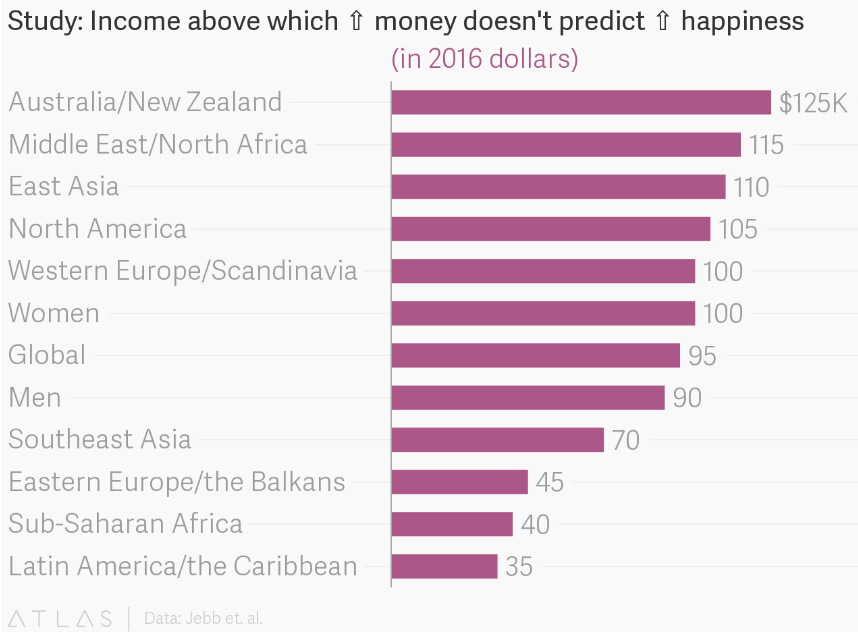

There is a study based on over 1 million people as part of the Gallup World Poll. Respondents across the world were asked to rate their lives on a scale of 0-10, where 0 is the “worst possible life” and 10 is the “best possible life.” The researchers analyzed the relationship between this score and household income. They found that in every region of the world, after accounting for a person’s age, gender, and marital status, people with higher incomes are happier. But they also find that there is a level of income at which happiness no longer increases with more money. This varies by region, with Australia and New Zealand the highest and Latin America and the Caribbean the lowest.

They even find some evidence that in certain places, when incomes rise above the cutoff level, life satisfaction gets lower.

The chart below shows the “satiation point” for different areas of the world. The incomes are converted to US dollars and adjusted for variations in spending power across countries. In Australia, that point is $125,000. That is once you earn more than this, you don’t get any happier :)

Most people that come to see us tell us they feel like a hamster on a treadmill. I often feel our role as professional advisers is to ask whether people want to be on that treadmill and if so, what is their purpose, what is their why? How can we help them achieve their why or their purpose by lining up their money with their life.

How do you line up your money with your why?

(Independent Wealth Partners Pty Ltd (ASIC # 1286417 ABN 66 647 667 249) is an independent professional financial advice practice which operates under the Australian Financial Services Licence (Independent Wealth Services AFSL # 512433).

This document is general advice only and it does not take into account any person’s individual objectives, financial situation or needs.

IMPORTANT: The projections or other information generated regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.