Our model portfolios are our best thinking around how to put together portfolios designed to meet our clients objectives

In order to determine an appropriate investment strategy that is most likely to be “successful” for an investor, it is necessary to be clear on the investment purpose and the investment beliefs the investor holds. These are the foundational elements that should influence and inform the risk profile that is adopted and also the investment strategy chosen to reflect that risk profile.

This paper explores our framework for designing our model portfolios. Wenexplain the rationale for the asset allocation of the funds and discuss the importance of some key implementation considerations, as well as portfolio construction principles.

In constructing the model portfolios, IWP has worked closely with WTW, a global leader in providing investment advice and implementation solutions to investors with over $4.8 trillion in assets under advice.

The Investment Process

The investment process is continuous and can be categorised into a 5-stage cycle which repeats itself:

1. The investment purpose is outlined, and the investment beliefs are agreed upon

2. A risk budget is set, investment constraints are set out whilst the risk and return objectives are outlined. The strategic asset allocation will be determined subsequent to this.

3. Portfolio construction delves into the granular strategic allocations within asset classes based off the beliefs outlined earlier. This also incorporates any risk management or hedging frameworks.

4. During the implementation stage the manager selection process occurs, as well as any operational management such as rebalancing.

5. The cycle ends in the monitoring stage, where performance reporting occurs as well as forward and backward looking risk and return analysis.

This process is then continuously repeated.

This paper summarises our approach to the first three stages of the investment process. We outline our investment purpose and beliefs, explain the approach to strategic asset allocation and dive into the portfolio construction process.

Investment Purpose

We have a strong belief that having a clear investment purpose is pivotal to successful long term

investing. In our view, it is hard to overestimate the importance of having a well articulated investment purpose, and creating a shared framework that all stakeholders can align to and buy into.

In the case of IWP, the investment purpose is very clear. The investment portfolios built by IWP for our clients are a means to an end; the investment portfolios themselves are not the key focus in the advice IWP delivers.

Hence, the underlying purpose of IWP’s investment activities is to achieve better outcomes for our clients, such that IWP can act as an enabler, increasing financial stability and allowing clients to live the life they want.

Investment Beliefs

Investment beliefs comprise what we know, or think we know, about the factors that influence investment returns. Some investment beliefs can be stated with a high degree of certainty, whilst others are more open to debate or interpretation. Collectively, they reflect the views held by IWP in consultation with WTW and help to guide investment decision making. Having a well thought out set of beliefs helps guide investment decision making by enhancing discipline and consistency, efficiently settling differences of opinion, and improving transparency. Our investment beliefs are outlined below:

Diversification, but not overdiversification, is important and protects against uncertain futures.

Diversification is a fundamental principle of risk management in investing. By spreading investments across various asset classes, such as equities, fixed income, and real assets (through property and infrastructure), an investor can reduce the impact of poor performance in any single asset class. This helps protect the portfolio against uncertain or volatile market conditions. However, it's important not to over-diversify, as having too many assets can dilute potential returns and complicate the management of the portfolio.

Minimising investment costs improves the chance of better long term outcomes.

Investment costs, including management fees, trading costs, and taxes, can erode the returns of an investment portfolio over time. Minimising these costs is crucial for achieving better long-term outcomes. Lower fees mean that a larger portion of the returns generated by the investments remains in the investor's pocket, ultimately leading to higher overall returns and wealth accumulation over time.

IWP has a preference for passive over active management, with a strong belief that index investing will beat active investing most of the time.

IWP has a firm belief that passive management (against an appropriate benchmark) should always be the default starting position for all portfolios. Active management should only be used where there is a high degree of confidence that there will be a sufficiently large reward for the risk associated with taking active positions relative to the benchmark.

IWP invests with a long term mindset, aiming to meet the long term cash flow needs of its clients.

Taking a long-term perspective in investing means focusing on the objectives and needs of investors over extended periods. This typically involves planning for financial goals like retirement, education, or buying a home and aligning investment strategies to meet these objectives over time, rather than trying to profit from short-term market fluctuations.

IWP prioritises the achievement of a desired level of return, rather than targeting a level of risk.

This approach emphasizes the importance of generating returns that meet the financial goals of investors, rather than solely focusing on managing risk. It acknowledges that some level of risk is inherent in investing and that risk should be accepted when it is necessary to achieve the desired return.

IWP defines risk as ‘market risk’, with the ultimate need being to minimise risk for a given level of return, as measured by volatility and downside risk.

Market risk refers to the potential for investments to fluctuate in value due to market movements. This approach recognizes that the primary concern is to minimize this market risk while achieving the desired return, typically measured through metrics like volatility (how much an investment's value tends to fluctuate) and downside risk (the risk of significant losses).

IWP utilises a long term Strategic Asset Allocation (SAA), rather than aiming to add value via shorter term dynamic asset allocation decisions.

Strategic Asset Allocation involves setting a target allocation to various asset classes and maintaining it over the long term. This approach is more about creating a well- balanced, diversified portfolio and sticking with it, rather than frequently adjusting the allocation in response to market conditions, which is the focus of dynamic asset allocation.

IWP recognises the responsibility to invest ethically and sustainably.

Ethical and sustainable investing takes into account environmental, social, and governance (ESG) factors when making investment decisions. It involves considering the impact of investments on society and the environment and aligning investments with ethical and sustainability values.

Liquidity is important, with a maximum liquidity timeframe of 30 days.

Liquidity is the ease with which an investment can be bought or sold without significantly impacting its price. This point emphasizes the need for investments to be reasonably liquid, with the ability to convert them to cash within 30 days, providing flexibility to meet short-term financial needs or to respond to changing market conditions without undue delays.

Strategic Asset Allocation Approach

IWP draws on the expertise of WTW to assist with both asset allocation and underlying investment manager selection. WTW utilise their Global Asset Model to help us understand the risk and return profiles of various asset classes investment strategies, and this helps to inform our asset allocation decisions. We recognise that investment decisions need to balance quantitative analysis with expert judgement to reflect considerations which cannot be fully captured within a model and therefore also incorporate qualitative factors into the process, based on the knowledge and judgement of WTW’s experienced investment team.

WTW’s Investment Assumptions Committee (“IAC”), which comprises senior specialist asset allocation consultants from around the world, is responsible for developing a set of forward-looking assumptions for all the major markets. In Australia, WTW’s Investment Strategy team work closely with the IAC to arrive at a robust set of asset class assumptions for Australian investors. The IAC formally reviews and recalibrates the asset class assumptions and models on a quarterly basis and conducts a more thorough review of all assumptions annually. The approach taken to assumption setting is generally based around a belief that markets are broadly efficient with the aim to estimate what future investment returns might be achieved in a central or neutral scenario, taking into account current conditions. The assumptions are derived through a blend of economic theory, historical analysis, views of investment managers and inevitably contain an element of subjective judgement. The factors taken into account in annual and quarterly reviews are:

Economic conditions, market yields, price-to-earnings ratios and other market data;

Historical data on investment returns, correlations and volatilities;

Central banks' forecasts and objectives;

Our annual survey of investment managers' asset class risk and return expectations;

Meetings with economic commentators and investment managers;

Feedback from clients and their advisers;

The latest trade/academic papers on the subject.

Overall, we, in collaboration with WTW, aim to draw together as many different sources of information as possible into the process, recognising that it is unlikely that any single input or formula will consistently provide a reasonable estimate for future returns.

We utilise this SAA approach in designing our model portfolios. The growth profile of the model portfolios can be seen in the table below:

Overall, we, in collaboration with WTW, aim to draw together as many different sources of information as possible into the process, recognising that it is unlikely that any single input or formula will consistently provide a reasonable estimate for future returns.

We utilise this SAA approach in designing our model portfolios. The growth profile of the model portfolios can be seen in the table below:

The models cover a different mix of growth and defensive assets across listed equities, fixed income and listed real assets, and cater to a variety of goals and risk tolerances such that there is a range of portfolios across the risk spectrum ready to suit the various needs and risk appetites of our clients.

Portfolio Construction

Active vs Passive Management

As a general rule, we believe that investors and investment managers have overly optimistic views and expectations from active management. Investors often fail to appreciate that active management is a zero sum game. In fact after fees and costs, it becomes a negative sum game. There will always be more losers than winners. To be successful at active management requires strong governance in order to provide a competitive advantage.

To invest actively in any asset class, we must believe all of the following propositions:

Alpha opportunities exist.

Markets aren’t always efficient, providing the potential for pricing anomalies to be exploited.

Skilful managers can extract alpha, such that the returns out-weigh the costs.

Some managers have unique or scarce insights and are able to exploit market anomalies.

The alpha opportunity is greater than any fees, transaction costs, and tax implications.

The opportunity to invest with these skilful managers exists.

There are high-quality managers available who are able to consistently identify alpha in advance using a disciplined and repeatable process

The expertise and resources to change managers at the right time exists.

Should we have doubts about any of the above propositions, then a passive management solution is appropriate.

We do believe that there is a case for active management in certain asset classes, but that each asset class needs to be analysed individually, and that it requires rigorous research and monitoring, and high levels of governance.

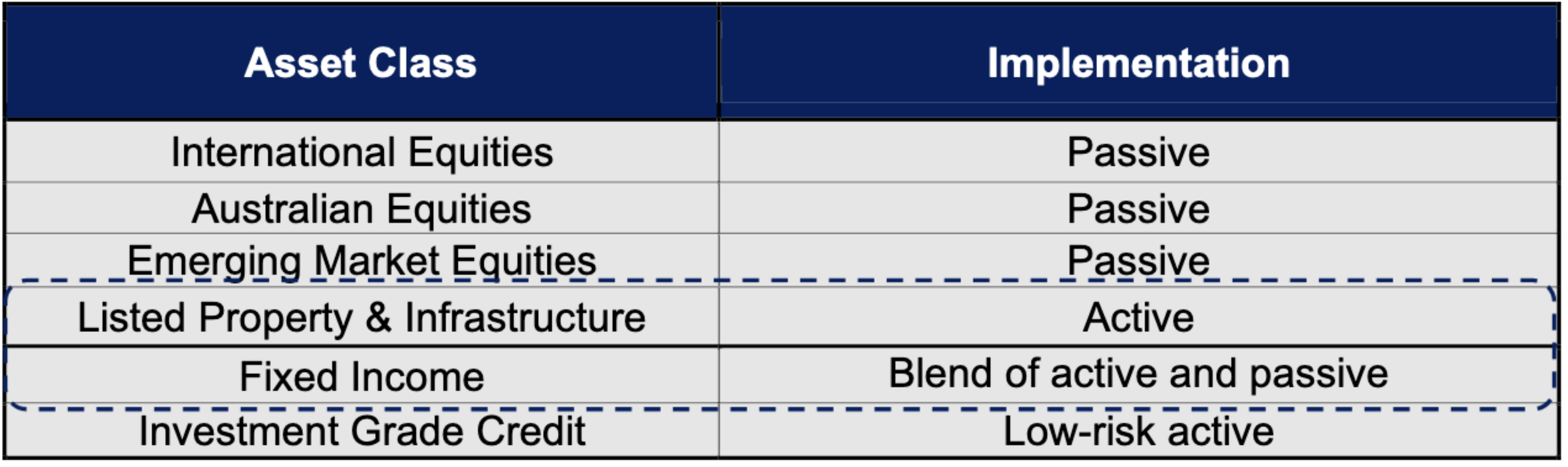

Based off the above the following decisions have been made regarding active and passive management within the model portfolios:

The minimum risk position occurs between a 20%-30% allocation to Australian equities. The maximum level of efficiency occurs for allocations between 30%-50%. It is important to bear in mind the limits of this quantitative modelling. We overlay our qualitative judgement to arrive at an equity allocation of 30% for Australian exposure within our equity portfolios. This takes into consideration the concentration of the Australian equity market, particularly with regards to its financials and materials sector exposures.

Small cap equity exposure

Small cap stocks comprise around 10-15% of the broad MSCI global equity universe. The efficient market hypothesis would suggest that the neutral starting position for an equity portfolio is to allocate a portion of the portfolio to small caps in proportion to small caps’ share of the market. The conventional argument for small cap equities is that allocations to them tend to enhance returns from large cap equity portfolios as they are more leveraged to economic growth and may potentially offer an illiquidity premium.

While an allocation to small-cap managers can potentially be justified, we believe that broader global developed and emerging market equities already represent a good degree of diversification in terms of sectors and regions without the need to access the small cap space for this purpose. An allocation to small caps also adds further complexity to a portfolio.

Lastly, we note that fees on small cap investments are relatively expensive and we would ideally prefer to access small caps on an active basis which contributes even further to the fee load.

Fixed Income Portfolio Construction

Our philosophy around fixed income portfolio construction is based on the following beliefs:

Client portfolios should, to the greatest extent possible, seek exposure to a broad array of risks and be robust to a range of macroeconomic environments.

Downside risk management should be the primary consideration in fixed income portfolio construction

While the fixed income universe represents a very broad opportunity set, fixed income portfolios should be limited to high quality (investment-grade) securities.

The investment grade fixed income universe comprises a broad opportunity set and can be defined as: nominal and inflation-linked government bonds, investment grade corporate bonds, and high-quality credit. Each of these sub-asset classes has relatively unique risk and return characteristics, which can be combined to build a desired portfolio.

We believe the two main drivers of financial market returns are growth and inflation. At any point in time, market pricing incorporates investor expectations about these two variables, with subsequent returns impacted by divergences between reality and discounted expectations, and by changes in expectations. We also believe that growth and inflation are notoriously difficult to predict with any accuracy. As such, our preference is for fixed income portfolios to be reasonably “all weather” in orientation – that is, robust to a range of growth and inflation outcomes – rather than built for only periods of “bad weather” (e.g. a recession or depression) or “fair weather” (e.g. periods of moderate growth and inflation). Fixed income plays an important role in achieving this balance.

The most important risk within a fixed income portfolio is its exposure to changes in interest rates, the sensitivity of which is measured by the interest rate duration of the portfolio. Interest rate duration is a key tool for managing overall portfolio risk and can provide diversification against equity market risk, particularly in the event of a significant market downturn. In general, we aim to allocate a greater exposure to interest rate duration as the exposure to growth assets increases in a portfolio.

We believe the unique investment objectives of a multi-asset portfolio, and its asset allocation, to be key factors in determining the optimal fixed income exposure, and that this will necessarily differ from one multi-asset portfolio to another. The key reasons for investing in fixed income are as follows:

A source of liquidity – after cash, fixed income is often viewed as one of the primary sources of liquidity in a multi-asset portfolio.

Capital stability – Fixed income can be constructed such that it exhibits a relatively low level of risk (e.g. focusing on cash and lower duration bonds) which reduces the probability of the overall portfolio delivering a negative return

Returns in different environments – Combining nominal bonds, inflation-linked bonds and credit can result in a portfolio that is fairly robust to a range of macroeconomic and market environments

A hedge against poorly performing growth assets – Fixed income can be constructed such that it exhibits a low or negative correlation with growth assets

The second and third points above relate primarily to lower risk multi-asset portfolios (ie. Lifestyle Model 1) where fixed income is used a means of providing investors with low risk, stable outcomes across a range of market environments. The last point above relates primarily to higher risk multi- asset portfolios (ie. Lifestyle Model 3 and Lifestyle Model 4) where the emphasis is on utilising fixed income as a downside risk mitigant for when growth asset performance is poor.

Within fixed income, we believe a blend of both active and passive strategies is appropriate. From a portfolio construction perspective, the key purpose of fixed income is to provide capital preservation (for conservative-style multi-asset portfolios) and downside protection (for growth-style multi-asset portfolios). As a result, we prefer a passive or lower-tracking error active approach within fixed income which is low cost and provides a dependable return profile. Active strategies are used in order to gain access to some shorter-term inflation linkages and this return profile cannot be accessed passively.

Listed Real Assets Portfolio Construction

‘Real Assets’ as an asset class can be categorised into two sub-asset classes:

Property

Real estate such as shopping malls, office buildings and industrial warehouses

Infrastructure

Infrastructure comprises investments in physical assets that may provide essential services such as gas pipelines, ports, toll roads and utilities.

Both of these types of assets provide a range of diversification benefits such as inflation protection, in addition providing a consistent yield. While real assets are often accessed via unlisted funds, these structures don’t match our specifications due to their illiquidity, as well as complex fund structures.

Consequently, we utilise listed real assets to gain exposure to this asset class, which provide the opportunity to adhere to our beliefs in diversification, liquidity, and low fees when appropriate.

Within listed real assets we have a strong preference for active management as this approach can reduce risk within these asset classes. In particular, the global listed infrastructure index is highly exposed to assets which are economically sensitive and have a more volatile earnings and return profile. The global listed property index includes exposure to a number of sectors with distinct return drivers and hence managers are able to rotate their allocation across sectors and reduce exposure to those with greater near-term risks. Within both global listed property and infrastructure, we believe active management can greatly reduce risk (and generate additional return) relative to a passive approach.

Foreign Currency Exposure

Over the period since the Australian dollar was floated in 1983, foreign currency exposure has exhibited the following characteristics for AUD-based investors:

Foreign currency exposure has imparted a return drag. Since 1983, the cost of not hedging (ie. Leaving foreign currency exposure unhedged) has been around 1.5%-2% p.a. based on a MSCI World weighted currency basket.

Annual volatility of foreign currency exposure has averaged around 10% p.a.

Correlations of foreign currency returns with equities have mostly been negative. In addition to this, correlations with equities have tended to become more negative when equity returns are poor.

The AUD has tended to depreciate during adverse financial market events resulting in foreign currency exposure providing a potentially useful downside risk mitigator for Australian investors.

Whilst foreign currency exposure does, at times, introduce additional volatility to a portfolio’s returns, on average the correlation of foreign currency returns to equities for an Australian investor is low, and in times of significant equity market corrections it is likely to be negative, leading to strong diversification benefits.

As a result, the primary purpose of foreign currency exposure within our portfolio construction process is to act as a potential hedge against “tail” risk or equity market drawdowns.

In terms of sizing the level of foreign currency exposure within a portfolio, we note that there is no single “optimal” level. Overall, we believe that the exposure to foreign currency should be scaled upwards in line with the increasing level of equity risk in a portfolio.

Conclusion

Our model portfolios are professionally managed diversified multi-asset solutions whose design reflects our key investment beliefs. They utilise the global expertise of WTW in capital markets and portfolio construction research as well as our extensive practical experience with our clients.

To the detriment of their portfolio and performance, many investors focus on the shorter-term movements in markets, the economy, individual manager performance, or the performance of a given security or strategy instead of focusing their attention on the core fundamentals of balanced asset allocation and a long-term investment perspective.

We believe a robust top-down approach to asset allocation and a straightforward design that keeps investment costs low offers investors the best chance of investment success.

About WTW Investments

WTW is a leading global advisory, broking and solutions company that helps clients turn risk into a path for growth. With roots dating to 1828, WTW has 45,000 employees serving more than 140 countries. We deliver solutions that manage risk, optimise benefits, cultivate talent and expand the power of capital to protect and strengthen institutions and individuals.

WTW has two business segments: Health, Wealth & Career and Corporate Risk & Broking. Our segments develop and deliver world-class capabilities and innovation on behalf of clients.

WTW Investments is a global line of business that sits within the Health, Wealth & Career business segment, providing investment advice and implementation solutions to investors. Globally we have been trusted to provide advice on over A$4.8 trillion across 1,400+ clients. We also have over A$254 billion of assets under management across 465 clients globally (at 31 March 2023).

We bring to our clients a range of expertise in risk management, strategic and dynamic asset allocation, portfolio construction, investment manager selection, sustainable investment, investment governance, and delegated investment solutions. We have a worldwide network of 1,000+ colleagues based in key global financial centres including London, New York, Frankfurt, Hong Kong, and Tokyo.

We have ~35 colleagues located in Sydney, Melbourne and Brisbane to support our Australian clients.

WTW was again ranked as the number one Australian asset consultant in the Peter Lee Associates 2023 Investment Management Client Survey, retaining our #1 Relationship Strength position for the fourth year in a row.

Notably, WTW was ranked first in four research and advisory categories,namely: (1) Investment Strategy; (2) Risk Assessment & Advice; (3) Dynamic Asset Allocation Advice; and (4) Sustainability Advice.

(Independent Wealth Partners Pty Ltd (ASIC # 1286417 ABN 66 647 667 249) is an independent professional financial advice practice which operates under the Australian Financial Services Licence (Independent Wealth Services AFSL # 512433).

This document is general advice only and it does not take into account any person’s individual objectives, financial situation or needs.

IMPORTANT: The projections or other information generated regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.